By Rinki Pandey December 16, 2025

Manual activities remain the leading cause of the slowdown in finance and operations teams across various industries. This is often the case without the leaders being aware of the full cost. The transactions wait for approvals sometimes forever in the inboxes, the spreadsheets are endlessly moving between departments, data is entering more than once, and the accountability gets blurred. These inefficiencies not only raise the risk factor but also shorten the time for making decisions and limit growth.

This is where getting the workflow automation rules comes into play as a game-changing factor. By setting up clear logic, structured triggers, and predefined actions, organizations get rid of repetitive work. It also creates predictable, scalable, and consistent workflows that operate with control.

This article shows organizations how workflow automation rules can help to get rid of manual processes, enhance finance and operations automation, and eventually obtain long-term efficiency through structured business process automation that is throughout growth and governance.

Workflow Automation Rules and the Shift Away from Manual Operations

The rules of workflow automation decide and direct a task’s transition from one activity or step to another without requiring continuous human intervention. The workflow automation rules determine:

- How to start a workflow?

- Who is responsible for performing each workflow task?

- What are the criteria that must be met for a task to be considered done?

- How to assess the results or the output linked to a particular task?

Workflow automation provides a systematic way of processing work without needing to continuously use personal judgment and memory. In finance and operations departments, the creation of manual workflows typically evolves organically as teams quickly attempt to resolve issues. The shift to email communication, shared file storage, and informal approvals has become standard. Consequently, the rules of workflow automation present the finance and operations departments with a structured and rational manner of processing the work, thus making it possible to switch from a manual to an automated approach without losing control.

Also Read: Job Costing Without Chaos: Estimate vs Actuals

Workflow Automation Rules as the Foundation of Finance and Operations Automation

Predictable results are an essential element of finance and operations automation’s ability to automate. As a result, this requires using tools based on a defined logic that enables them to add value. In order for all systems, departments, and data to be one connected process, workflow-based automation establishes the framework for connectivity. This establishes what actions should occur first and at what timeframe.

For finance, operational automation defines how to approve transactions, validate transactions, and make scheduling decisions that have an impact on a company’s cash flow and compliance. Operational workflow automation, on the other hand, creates and captures the processes for managing operational requests, operational changes, and operational support across various departments within a single organization. When organizations implement similar workflow-attributed automation rule sets across multiple departments within their organization, they can deliver more predictable results on a larger scale, which in turn aligns the finance and operations automation directly with an organization’s overall goals for business process automation.

Workflow Automation Rules That Remove Manual Processes in Finance

Repeating chores that give minimal strategic value are taking up most of the time of finance teams most of the time. Automation of workflows has a great impact on the removal of manual processes by making the decision-making and execution process uniform across the board. Not having to go through each transaction manually, financial teams can count on preestablished logic that automatically handles regular work.

The underwriting of automation rules speeds up and makes the processes of invoice matching, expense validation, payment scheduling, and financial closing. This level of precision guarantees that the automation of finance and operations will continue to be effective even when there is a rise in transaction volumes and the complexity of the organization increases.

Workflow Automation Rules That Improve Operational Efficiency

The operations teams are always under the same pressure to deliver results that are not only fast but also accurate and of high quality. One of the greatest benefits that comes along with the automation of workflow rules is the improved operational efficiency through the elimination of unnecessary handoffs, delays, and manual coordination between the different teams. Tasks are eventually routed automatically to the right people according to the conditions set beforehand rather than through manual assignment.

With the coming of automation, the process management for the operations teams has significantly reduced, while the efficiency of the outcome has improved. This way of managing the operations remains quite helpful in the field of business process automation because it guarantees that the operation workflows are kept consistent, traced, and flexible to the changes in the business needs.

Workflow Automation Rules and Their Role in Business Process Automation

Business process automation is all about automating the entire workflow instead of just the individual tasks. The implementation of automation is made possible with the help of workflow automation rules, which are based on defining the interactions between each step in a predictable sequence. Without well-defined rules, automation turns into a brittle and hard-to-maintain procedure.

The companies will reap the benefits of automated processes that are repeatable, auditable, and scalable if strong workflow automation rules are present. It is particularly true for finance and payable automation, where mistakes can result in financial losses or compliance problems. Setting up the rules clearly means that every workflow will apply the same logic, irrespective of the person who triggers it.

Workflow Automation Rules That Reduce Errors and Compliance Risks

Manual methods are inevitably error-prone. The reliance of workflows solely on human activity frequently results in occurrences of missed approvals, wrong data input, and varied decisions. Workflow automation rules lower the risks associated with these errors by imposing validation checks and approval structures at every step of the process.

Using automated application of uniform policies, businesses not only increase precision but also make compliance stronger. This control is very important for the regulated sectors. Workflow automation rules enable enterprises to get rid of manual processes while still preserving visibility, traceability, and accountability in the finance and operations automation workflows.

Workflow Automation Rules for Cross-Department Collaboration

Finance and operations hardly ever work in isolation. The majority of workflows go through several teams, systems, and approval levels. Workflow automation rules provide the necessary coordination of these interactions by allowing the information to move across the departments without any need for follow-ups or reminders.

In the case of automated workflows, an action taken in one department instantly becomes an update in another. This synchronization makes the most of finance and operations automation while communication gaps get smaller. Consequently, the organization’s business process automation is more fluid and trustworthy.

Workflow Automation Rules and Data-Driven Decision Making

One of the major benefits of workflow automation is visibility that has been increased visibility. Leaders would then be able to analyze the structured and reliable data generated by automated workflows to better understand the performance of the organization. The metrics derived from the actual processes provide insights to the decision makers, and they do not have to depend on assumptions anymore.

Getting rid of delays, bottlenecks, and compliance gaps is going to be a much easier task for the organizations. This data is going to be their ally in continuous optimization for a long time. Business process automation gets smarter as it applies workflow automation rules that are supported by hard data rather than intuition.

Workflow Automation Rules That Scale with Business Growth

When an organization expands, manual procedures gradually become unable to keep up. What is manageable in terms of volume turns into a slow, error-prone process at scale very soon. Workflow automation rules allow for limitless scalability without needing a corresponding increase in staff or management effort.

Organizations that set up their workflows uniformly from the start guarantee that the automation of finance and operations is not interrupted by their growth. New workers get trained quickly, large quantities are processed without hiccups, and the business process automation continues to be the same despite more challenges coming up.

Workflow Automation Rules for Exception Handling

There is no such thing as a completely automated process without some exceptions. The rules of workflow automation deal with this reality by specifying when human intervention is needed. Common transactions are processed automatically, whereas exceptions or high-risk situations are dealt with according to the set procedure.

Such a way of working enables companies to get rid of human intervention in the regular work while still having a say in the important decisions. Exception management turns out to be systematic and efficient, thus reinforcing finance and operations automation without considerable strain on the teams involved.

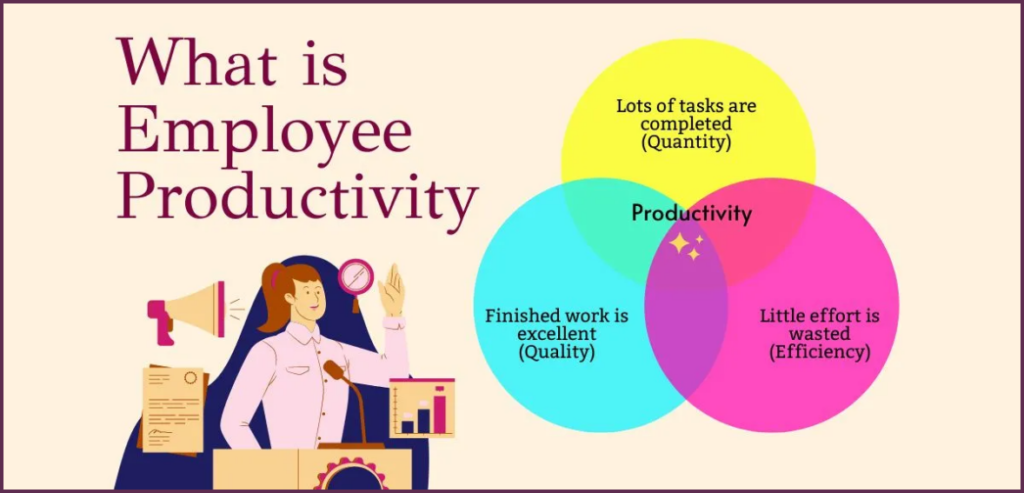

Workflow Automation Rules and Employee Productivity

Elimination of manual operations does not eliminate the need for humans. It is the workflow automation rules that transform the manner of staff participation. Employee time released from repetitive tasks can now be utilized for analysis, planning, and enhancing the organization.

This change boosts the production and the satisfaction of the job. When their work is contributing rather than just dealing with the routine approvals, the employees feel more engaged. Business process automation under clear rules achieves the alignment of operational efficiency with the provision of a more meaningful employee experience.

Workflow Automation Rules and Cost Optimization

The use of manual processes incurs high expenses owing to the unavoidable time delays, errors, and rework. However, the application of automation rules in workflows leads to the direct support of cost optimization through the reduction of the processing time and the enhancement of the accuracy. Moreover, the realization of faster workflows brings along better cash management, with the visibility and control aspects improved.

Temporary workforce and manual work are gradually ceasing to be the organizations’ resort as finance and operations automation reaches its mature stage. Moreover, business process automation has turned into a sustainable method of controlling operational costs while still ensuring quality and compliance.

Workflow Automation Rules and Future-Ready Operations

There is no doubt that the future of work is very much a matter of automation, connections, and data. Therefore, organizations need to adopt workflow automation rules that will prepare them for this future and, at the same time, have advanced technologies integration that can be easily achieved through the structured processes they create.

Artificial intelligence and analytics are reliability factors that will always be there in workflows that are neat, rule-based, and automated. In the case of finance and operations, if strong workflow automation rules are in place, the future of being integrated with intelligent automation will be a hassle-free process.

Final Thoughts

Automation rules for the workflow are not simply technical settings; they are an organization’s reflection at a different level in its thinking, decision-making, and daily operations. When they are carefully designed, they become the source of power that drives the manual processes, which slow down the teams and create risks to be eliminated. Well-defined rules provide uniformity in making decisions, increase accuracy in the whole process, and lay a strong ground for finance and operations automation to be done efficiently and at a large scale.

The organizations that are investing in clear-cut and adaptable automation rules for workflows are getting far more than just short-term efficiency. They are making themselves resilient in operations, and they are collaborating well among the teams, and the systems they have developed are capable of adapting to the changes in the business. Slowly, these rules will be the ones that facilitate sustainable growth, stricter governance, and measurable performance increases. In the end, the success of the business process automation rests on the clarity, discipline, and foresight that are inherent in the workflow automation rules.

FAQs

What do you understand exactly by workflow automation rules?

The automation of workflow rules is executed in such a way that tasks can be automatically moved from one stage to another in a process according to the predetermined conditions and actions.

How do workflow automation rules contribute to the finance and operations automation of the company?

They simplify the process of approval, verification, and transferring, which in turn leads to the finance and operations automation.

Are workflow automation rules capable of eliminating manual processes in the organization?

They do away with manual work for ordinary jobs, but at the same time clearly indicate the cases that require human intervention for review.

Where do workflow automation rules feature in the business process automation improvement?

They convert workflows to be repetitive, auditable, and scalable, thus making the overall business process automation results stronger.

Can rules for workflow automation consider small and medium-sized businesses?

Definitely, they let finance and operations automation get the benefit of scaling up by simply handling the increase in volume while keeping the same level of complexity.