By Stephanie Jones November 5, 2025

In today’s fast-paced business environment, cash flow visibility and efficiency are just as critical as sales growth. Companies often find that the delay between sending an invoice and receiving payment, their Days Sales Outstanding (DSO), can choke their liquidity and stall growth. While digital invoicing has become common, the next step in financial evolution is embedding payments directly into cloud ERP software. With pay-by-link options and automatic reconciliation built into a centralized system, businesses can accelerate collections, reduce errors, and achieve true operational harmony.

The concept of embedded payments in business management software is not new, but its adoption is transforming how companies handle everyday transactions. By integrating merchant services directly within the ERP, finance teams can turn billing into instant cash collection rather than a follow-up process that drags on for weeks. When paired with automation tools like auto-reconciliation, this approach eliminates tedious manual matching, freeing teams to focus on higher-value tasks that drive business improvement.

The Evolution of Payment Workflows in Cloud ERP Systems

The shift from manual to digital finance operations has redefined how organizations manage accounts receivable. Early accounting ERP systems helped record transactions, but payment collection remained a separate process involving banks, gateways, or manual reconciliation. Today, embedded payments create a closed-loop workflow where everything from invoicing to settlement occurs within the same cloud business software environment.

Modern ERPs that integrate payment solutions make it easier for customers to pay directly from the invoice using secure pay-by-link technology. This not only shortens the DSO but also reduces human error that typically occurs when reconciling payments manually. Moreover, for businesses that handle recurring billing or high transaction volumes, integrated merchant services provide a reliable framework for scaling operations without increasing administrative overhead.

In sectors like retail, distribution, and field services, where transaction frequency is high, the combination of ERP with payments integration allows companies to track cash flow in real time. Payment data syncs instantly with sales, accounting, and inventory records, ensuring that every transaction is reflected accurately across departments.

Why DSO Matters More Than Ever

DSO is one of the most important metrics for financial health. It measures how long it takes for a business to collect cash after a sale. In many industries, reducing DSO by even a few days can free up thousands of dollars in working capital. The challenge is that traditional invoicing and payment collection often involve multiple steps, systems, and stakeholders, leading to delays.

Embedding payments into business management software directly addresses this issue. When customers can pay invoices instantly via embedded links or terminals, payment friction disappears. The ERP automatically records the transaction, updates the balance, and reflects it in the general ledger. This immediacy not only speeds up collections but also gives finance leaders real-time visibility into liquidity.

The benefit is especially evident in industries where credit terms are standard but cash management is tight. With a cloud ERP software platform supporting integrated payments, businesses can establish more predictable cash cycles, improve forecasting accuracy, and reduce dependence on external financing.

How Embedded Payments Streamline Invoicing and Billing

Invoicing has long been a bottleneck in the order-to-cash cycle. A delay in sending or processing invoices can push payments further out, increasing DSO. Embedded payment capabilities within invoicing and billing software simplify this process by linking the invoice directly to the payment method.

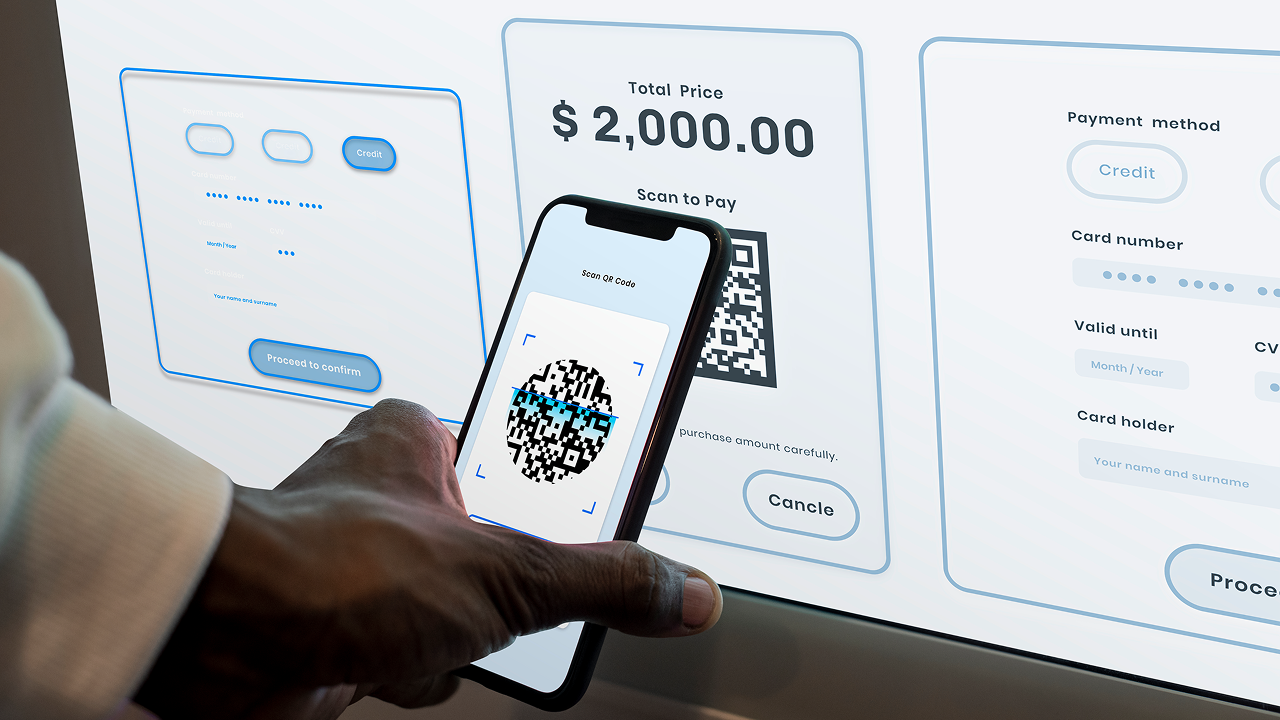

When an invoice is generated within the ERP, the customer receives an email containing a secure pay-by-link. They can complete the payment instantly using a preferred card, bank transfer, or wallet. Once the transaction is successful, the ERP marks the invoice as paid, and all related financial entries update automatically. This eliminates the need for manual input and reduces reconciliation effort.

Furthermore, integration with merchant services ensures that businesses can accept payments in multiple currencies, an advantage for those operating globally. The seamless flow between invoicing, payment, and reconciliation demonstrates how cloud business software has evolved into a unified ecosystem rather than a series of disconnected tools.

The Role of Auto-Reconciliation in Financial Accuracy

Reconciliation is one of the most time-consuming accounting tasks, often taking hours or days depending on transaction volume. When businesses rely on manual methods, they risk mismatched entries, missed payments, and inaccurate financial statements. Auto-reconciliation, powered by an embedded payment engine in accounting ERP, changes this equation entirely.

With automation, every incoming payment is automatically matched to the corresponding invoice based on reference numbers, transaction IDs, or customer details. The ERP flags discrepancies instantly, enabling faster resolution. This process not only enhances accuracy but also builds confidence in financial reporting.

By integrating merchant services integration directly into the ERP, businesses gain end-to-end visibility from payment initiation to posting. It becomes possible to close books faster, ensure compliance, and maintain clean audit trails. Over time, this accuracy translates into better decision-making and stronger relationships with both customers and auditors.

Pay-by-Link: A Simple Tool with a Big Impact

The pay-by-link feature is one of the most powerful yet underrated tools in modern ERP with payments solutions. It allows businesses to embed payment links directly into digital invoices, emails, or even SMS messages. This eliminates the need for customers to log into separate portals or make manual transfers.

For finance teams, the advantage is convenience and traceability. Every link is tied to a specific invoice and customer, ensuring transparency in every transaction. The ERP system updates in real time as soon as payment is received, automatically triggering the reconciliation workflow.

From a customer-experience perspective, pay-by-link simplifies the payment process. Whether the payer is a retail buyer, a corporate client, or a field-service customer, they can complete the transaction instantly using any device. This level of flexibility and accessibility makes pay-by-link an essential component of next-generation invoicing and billing software.

Integrating Merchant Services for Unified Operations

In the past, businesses had to rely on external payment processors disconnected from their business management software. That separation created silos and inefficiencies. By embedding merchant services integration directly into ERP systems, companies eliminate the gap between order entry and payment completion.

Integrated merchant services allow businesses to manage all payment types including credit, debit, ACH, or digital wallets within a single interface. These systems also offer features like tokenization, fraud detection, and multi-currency support, helping businesses maintain compliance and security without adding complexity.

When payment data flows directly into the cloud ERP software, accounting teams no longer need to wait for bank statements to reconcile revenue. The system provides instant visibility into daily transactions, enabling real-time financial management. This tight integration not only simplifies backend operations but also strengthens cash forecasting and customer trust.

Benefits for Inventory and Order Management

Payment and inventory systems have traditionally operated independently, but in a connected business environment, that division no longer makes sense. When embedded payments work alongside inventory management ERP, companies gain a comprehensive view of order status, payments, and stock levels.

For example, when a payment is received through a pay-by-link or terminal, the ERP automatically updates inventory quantities and marks the order as fulfilled. This synchronization helps prevent overselling and ensures accurate reporting across departments. It also minimizes the manual work associated with confirming whether an order was paid before shipment.

By aligning payments with order and inventory data, cloud business software transforms how businesses operate daily. The result is faster processing, fewer discrepancies, and improved customer satisfaction. The integration ensures that every part of the organization, from sales to finance to warehouse, is aligned with a single source of truth.

Accounting Simplified Through Automation

Traditional accounting workflows often involve a mix of spreadsheets, bank portals, and external tools. These disconnected systems create opportunities for data errors and inefficiencies. Embedded payments within accounting ERP bring all these functions into one unified environment.

When a payment is processed, journal entries are automatically created, tax codes are applied, and ledgers are updated in real time. This automation allows accounting teams to close books more quickly and with greater accuracy. It also enhances transparency, as every financial record can be traced back to its source transaction.

Furthermore, when the ERP includes embedded merchant services integration, businesses gain access to detailed analytics on transaction costs, settlement timelines, and payment trends. This insight helps organizations identify opportunities for process improvement and negotiate better rates with payment providers.

Improving Customer Experience Through Payment Convenience

Customers expect convenience at every stage of their interaction with a business. The payment experience is no exception. Offering embedded pay-by-link options directly through cloud ERP software not only reduces friction but also increases trust.

For clients, the ability to make instant, secure payments without complex logins or additional steps reflects professionalism and reliability. For businesses, it means faster collections and reduced administrative follow-ups. By using invoicing and billing software that integrates with merchant services, companies demonstrate responsiveness and flexibility, two qualities that strengthen customer relationships over time.

In industries like field services or distribution, where many transactions happen outside traditional office settings, mobile-friendly pay-by-link options provide an added layer of convenience. This customer-first approach ultimately supports stronger brand loyalty and smoother cash cycles.

Data Visibility and Financial Control

One of the greatest advantages of embedded payments within cloud business software is the level of financial visibility it provides. Traditional systems often leave finance teams waiting for reports from various departments. In contrast, integrated ERP with payments ensures every transaction is visible in real time across all modules.

This unified data flow helps businesses track revenue by customer, region, or service line. It also enables instant access to outstanding invoices, payment statuses, and settlement timelines. Managers can make faster decisions, identify potential cash flow bottlenecks, and plan for contingencies more effectively.

By leveraging accounting ERP analytics, businesses can monitor payment performance metrics, identify customers with recurring delays, and adjust credit terms accordingly. Such proactive financial management becomes possible only when payments and ERP functions work seamlessly together.

How Cloud ERP Enables Scalability in Finance

As organizations grow, their financial complexity increases. Multiple currencies, diverse payment methods, and higher transaction volumes demand a system capable of scaling effortlessly. Modern cloud ERP software provides that scalability, offering embedded payment capabilities that expand alongside the business.

Because all operations, from invoicing to payment to reconciliation, occur within one business management software ecosystem, companies can scale without duplicating systems or retraining teams. Cloud infrastructure ensures that as transaction volumes grow, processing power and storage adapt accordingly.

Additionally, embedded merchant services integration ensures businesses remain compliant with evolving financial regulations. Whether it’s PCI-DSS compliance for payment security or automated audit trails for tax authorities, cloud-based systems ensure continuous alignment with best practices.

Real-Time Insights for Decision Making

The ability to access real-time financial data is a key differentiator for organizations using ERP with payments. Executives can monitor cash inflows, outstanding receivables, and bank settlements without waiting for monthly reports. This real-time access supports better working capital management and strategic planning.

By connecting invoicing and billing software with payment data, companies can identify trends such as average payment time per customer or the effectiveness of pay-by-link campaigns. This insight empowers decision-makers to refine credit policies, optimize pricing, and adjust sales targets based on accurate, live data.

Ultimately, cloud business software turns raw payment transactions into actionable intelligence. With instant reconciliation and clear dashboards, organizations can measure financial performance not just historically, but dynamically as it happens.

The Future of ERP with Embedded Payments

The integration of payments into ERP systems represents a major shift in how businesses view financial management. What once required separate tools and departments is now unified under one cloud ERP software umbrella. The result is a more agile, data-driven, and customer-centric organization.

Future trends point toward even deeper automation. Artificial intelligence may soon predict late payments and trigger proactive reminders. Blockchain could add an additional layer of transparency and security. As merchant services integration continues to evolve, businesses will see greater interoperability between banking systems, ERPs, and mobile payment platforms.

Embedded payments are no longer an add-on feature but a fundamental part of how modern business management software delivers value. They transform finance from a reactive function into a proactive engine for growth.

Conclusion

Cutting DSO requires more than just faster billing; it requires smarter systems. Embedded payments within cloud business software allow organizations to connect every part of the order-to-cash cycle, from invoice generation to payment collection to reconciliation. By integrating merchant services integration directly into ERP with payments, companies not only improve operational efficiency but also gain real-time financial visibility.

Incorporating pay-by-link and auto-reconcile features within invoicing and billing software, accounting ERP, and inventory management ERP ensures that every transaction is captured accurately and instantly. This reduces manual intervention, improves liquidity, and strengthens the customer experience. For modern businesses, embedded payments in ERP are not just a technology upgrade; they are a financial strategy for speed, accuracy, and sustainable growth.